Basis Point

One one-hundredth of one percent (.01%).

Promoting the integrity of the municipal market since 1979

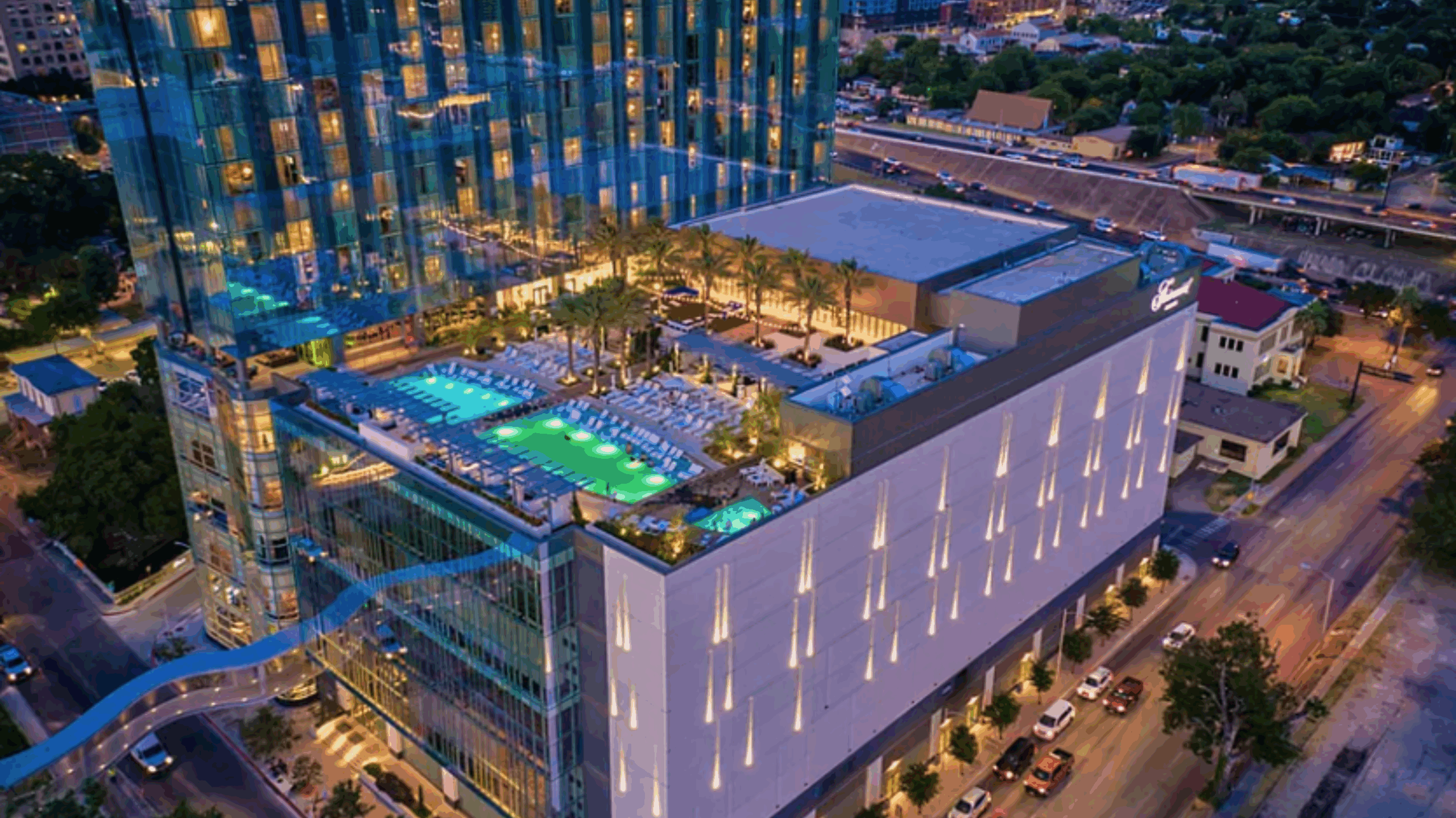

Foundational conference for attorneys and municipal market participants new to areas of bond law hosted in Austin, TX, April 8 – 10, 2026. Registration is now open!

Starting point and road map designed to aid practitioners through the process of conducting tax due diligence for governmental bonds.

A partner at Stradling Yocca Carlson & Rauth LLP, chair of The Institute 2026, and NABL member since 1989.

Proposed regulations from the U.S. Treasury Department would update certain arbitrage rules and definitions.

This on-demand offering is free and not eligible for CLE credit.

We are tracking the status of FY2026 appropriations, where things stand, and what it all means for bond lawyers.

+2,300Members

With more than 2,300 active members you will find a network and community for your practice.

101HouRs of CLE OPPORTUNITIES

We offer 101 hours of CLE courses at a 30 percent discount for our members.

95%Retention Rate

We’re supporting member goals by expanding networks and access to resources.

Victoria Ozimek, Bracewell LLP in Austin, TXIt’s a one-stop shopping experience for all of the resources that a bond lawyer might need.

Kareem J. Spratling, Bryant Miller Olive P.A in Tampa, FL.NABL’s in-person conferences are the most valuable for me. Whether you want to develop new business, step up your game intellectually, develop industry contacts, or keep up with CLE requirements— it’s all there.”

Kathleen C. McKinney, Haynsworth Sinkler Boyd, P.A. in Greenville, SCI could not imagine being a bond attorney for 40 years without the support NABL provided in keeping me current on the complex statutory and regulatory requirements of the practice.

Of the specialty bar association dedicated to public finance law.

One one-hundredth of one percent (.01%).