Response to SEC Corporate Climate Disclosure Rule

Response to the U.S. Securities and Exchange Commission’s (SEC’s) proposed rule on Enhancement and Standardization of Climate-Related Disclosures for Investors.

Environmental, Social, and Governance factors in the context of the municipal market.

Environment, Social, and Governance (ESG) factors have emerged as an area of debate within public finance— both from a labeling aspect, where issuers attempt to attract a broader class of investors by indicating their bonds target desired policy outcomes, and from a heightened risk assessment and disclosure aspect, where materiality and investor expectations are driving issuers to include greater information on perceived risks posed by these evolving issues.

Regulators and market participants have greatly increased their awareness and activities in the ESG space. In the past few years, the U.S. Securities and Exchange Commission (SEC) has proposed several rule changes relating to ESG that could either directly or indirect affect our municipal markets.

ESG is a rapidly developing issue with many nuances and complexities, but our core message comes down to three points:

Response to the U.S. Securities and Exchange Commission’s (SEC’s) proposed rule on Enhancement and Standardization of Climate-Related Disclosures for Investors.

Coalition comments from the Disclosure Industry Group in response to the Municipal Securities Rulemaking Board (the “MSRB”) relating to information on environmental, social and governance (“ESG”) practices in the municipal securities.

NABL comments submitted to the Municipal Securities Rulemaking Board (the “MSRB”) relating to MSRB Request for Information 2021-17 (the “Request”) requesting information on environmental, social and governance (“ESG”) practices in the municipal securities market, published December 8, 2021.

Response to a March 15, 2021 public invitation for input from U.S. Securities and Exchange Commissioner Allison Herren Lee on climate change disclosures.

New format, new topics, new Institute. Here’s a recap from this year’s conference and what you may have missed.

Key takeaways from the Senate Budget Committee’s hearing on Wednesday, January 10, 2024.

This panel will include practitioners and securities regulators discussing the most pressing federal securities law issues facing the municipal bond market, with a focus on how to implement practical and…

We took a break from the Wrap while Congress adjourned for August recess, but this month was nonetheless a busy one. Catch up quickly on updates from while we were…

A discussion session on NABL’s newest report examining legal considerations pertaining to risk factors disclosure was held on August 23, 2023.

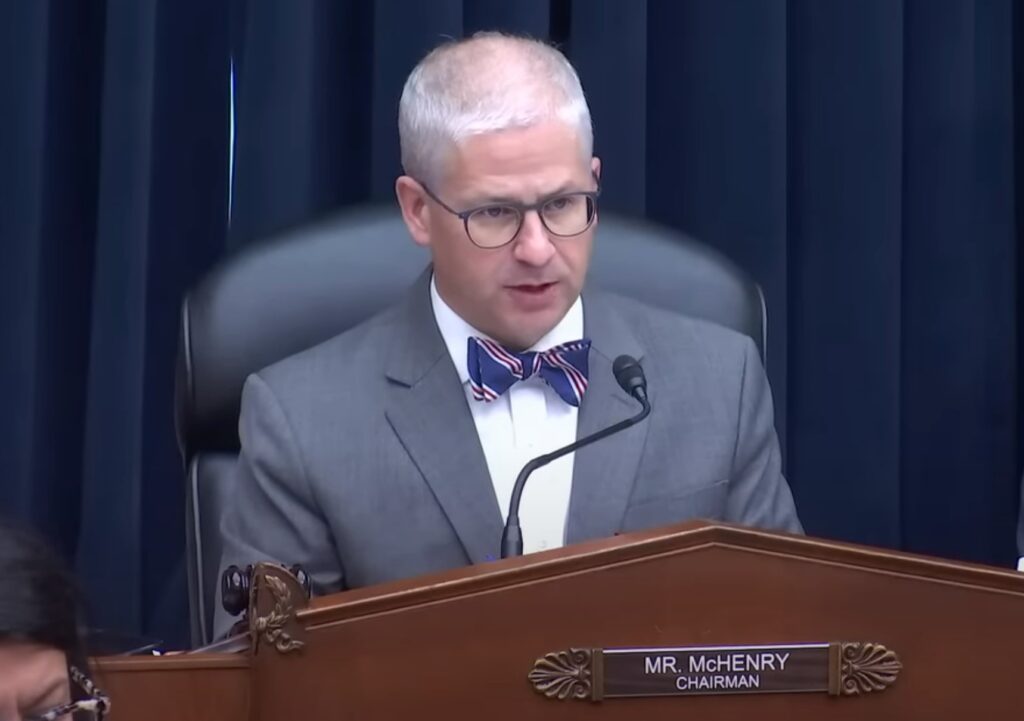

House Republicans have launched a month-long focus on Environmental, Social, and Governance (ESG) factors in financial markets. Here’s what we know.