Tax Cuts and Jobs Act (TCJA)

119th Congress Begins

The new Congress has begun with a long agenda on tap. Here’s what we know coming out of the gate.

Gearing Up for a Potential Tax Bill in 2025

Key provisions of the Tax Cuts and Jobs Act (TCJA) begin to expire at the end of next year, teeing up the likelihood of a major tax package in the…

Opportunity Zones & Economic Development Project Financing

Panel intended to help public finance attorneys understand the basics of Qualified Opportunity Zones and how to discuss them with municipal and private sector clients who may also be including…

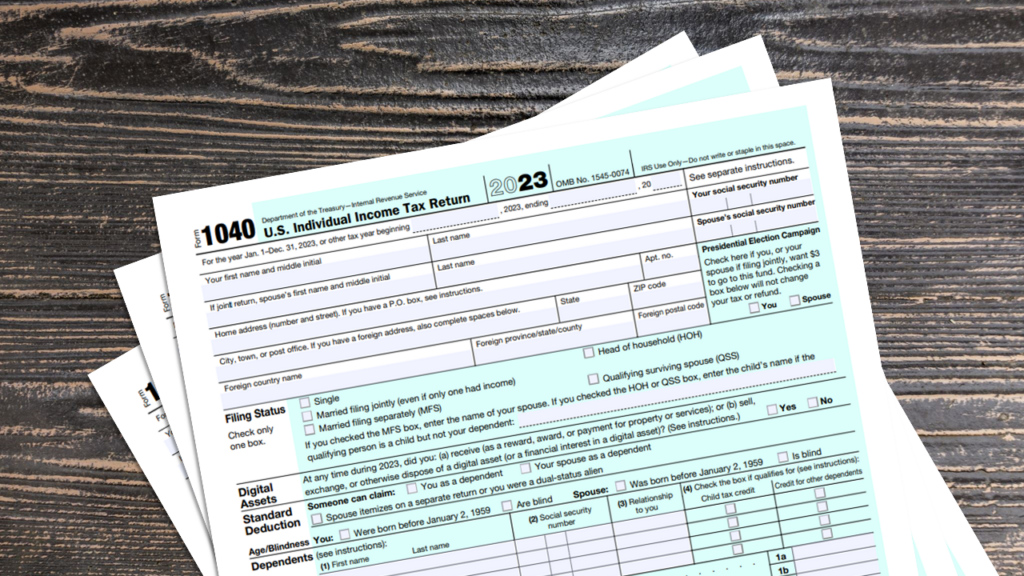

Tax Cuts and Jobs Act (TCJA) of 2017

Congress passed the Tax Cuts and Jobs Act (TCJA) in 2017. The large tax bill passed under reconciliation rules made major changes to the Internal Revenue Code (IRC), including the…

Letter on IRS PLR Fees (2019)

Request that the Internal Revenue Service (“IRS”) significantly lower the user fee it charges State and local governments for private letter rulings related to tax-advantaged bonds (the “User Fee”) and…

Requests for 2019-2020 IRS Priority Guidance Plan

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2019-2020 Priority Guidance Plan.

Request for IRS Guidance on Refunding of Taxable Bonds

Request that the Office of Indian Tribal Governments/Tax Exempt Bonds (“ITG/TEB”) provide written guidance regarding the treatment of tax-exempt bonds issued to advance refund taxable bonds that are not tax-advantaged…

Ban on Tax-Exempt Advance Refundings: Now What

The Tax Cuts and Jobs Act (TCJA) passed by Congress and signed into law on December 22, 2017 prohibits the issuance of tax-exempt advance refunding bonds after December 31, 2017.…

PFN Letter on Tax Reform (November 2017)

Letter from the Public Finance Network (PFN), including NABL, to members of the 115th Congress expressing opposition to the inclusion of provisions that would eliminate the tax exemptions for qualified…

Letter on Tax Reform (2017)

Letter to congressional leadership reiterating the importance of maintaining federal income tax treatment of state and local government bonds, including private activity bonds (PABs) and advance refunding bonds.

PFN Letter on Tax Reform Priorities and Concerns

Comments from the Public Finance Network (PFN) to the Ways and Means Committee as it begins its work on reforming the Internal Revenue Code (IRC).

PFN Letter to Senate Finance on Tax Reform (2017)

Comments from the Public Finance Network (PFN) to the Senate Finance Committee as it begins its work on reforming the Internal Revenue Code (IRC).