Requests for 2024-2025 IRS Priority Guidance Plan

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2024-2025 Priority Guidance Plan.

Large domestic policy package offering more than $400 billion in new federal investment and $300 billion in deficit reduction.

After more than a year of discussions on Build Back Better proposals, Congress passed the Inflation Reduction Act (IRA) in August of 2022. The large domestic policy package invests approximately $400 billion in healthcare, energy security, and climate change mitigation; and aims to reduce the deficit by about $300 billion over the next decade.

Official Title: An act to provide for reconciliation pursuant to title II of S. Con. Res. 14.

Short Title: Inflation Reduction Act (IRA) of 2022 (H.R. 5376)

Public L. No: 117-169

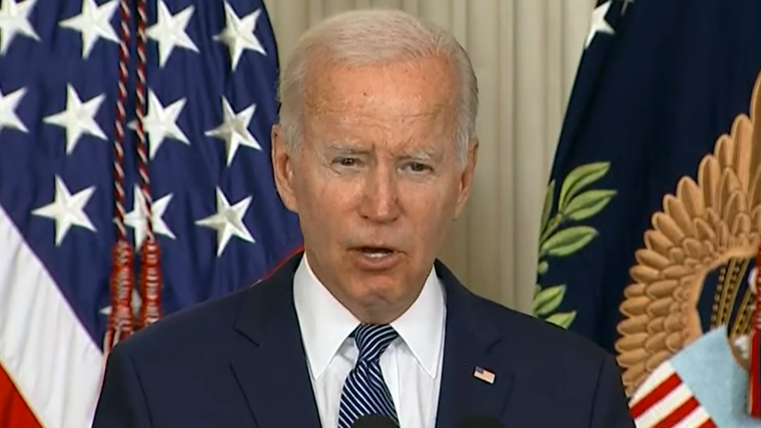

Members of the Congress and the Biden Administration deliberated for a year and a half on a historically large domestic policy agenda known as the Build Back Better plan. Initial proposals called for more than $3 trillion in new federal investment but were subsequently scaled down to secure a sufficient number of votes. These discussions culminated in the proposal and passage of IRA.

IRA was one of the most significant legislative achievements of the 117th Congress. In addition to introducing historic amounts of new federal investment in health, energy, and climate, the proposal also included a number of provisions that may directly and indirectly impact the municipal market.

NABL did not take a position on IRA but continues to monitor direct and indirect legal impacts of the legislation to the municipal market.

NABL has submitted multiple letters to Congress and in response to agency requests for comments on implementation of various aspects of IRA.

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2024-2025 Priority Guidance Plan.

Comment letter submitted to the Internal Revenue Service (IRS) in response to Proposed Regulations §§1.6417-1 through 1.6417-6 on Section 6417 Elective Payment of Applicable Credits (IRS REG – 101607-23).

Follow up comments to a November 4, 2022 letter sent by NABL suggesting various areas of need for guidance relating to certain tax provisions enacted under the Inflation Reduction Act (IRA).

Comments submitted in response to a solicitation from the Internal Revenue Service (Notices 2022-49 and 2022-50) for requests for guidance relating to certain tax law changes enacted by the Inflation Reduction Act (IRA).

Statement urging Congress to include additional tax tools to help state and local governments in any large domestic policy agenda bill.

The new Congress has begun with a long agenda on tap. Here’s what we know coming out of the gate.

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2024-2025 Priority Guidance Plan.

New format, new topics, new Institute. Here’s a recap from this year’s conference and what you may have missed.

Congress’ long campaign of “hurry up and wait” stretches into February; a tax deal passes the House but faces uncertainty in the Senate; FY2024 spending update; and the SEC suspends…

Comment letter submitted to the Internal Revenue Service (IRS) in response to Proposed Regulations §§1.6417-1 through 1.6417-6 on Section 6417 Elective Payment of Applicable Credits (IRS REG – 101607-23).

Follow up comments to a November 4, 2022 letter sent by NABL suggesting various areas of need for guidance relating to certain tax provisions enacted under the Inflation Reduction Act…