Issue Brief

Financial Data Transparency Act (FDTA)

Legislation passed at the end of 2022 to apply data standards to information submitted to and managed by several financial regulators, including the MSRB.

Congress included the Financial Data Transparency Act (“FDTA”) as a title in the National Defense Authorization Act (“NDAA”) for FY2023. The statute instructs a group of federal financial regulators to develop a set of shared data standards, and then instructs select agencies (including the U.S. Securities and Exchange Commission or “SEC”) to apply those standards to themselves and other self-regulating organizations (including the Municipal Securities Rulemaking Board or “MSRB”).

Authorizing Legislation

The FDTA was enacted via Title LVIII of the James M. Inhofe National Defense Authorization Act for Fiscal Year 2023 (H.R. 7776 of the 117th Congress), which passed into law on December 23, 2022.

NABL Response Comments

On October 21, 2024, NABL responded to the Proposed Joint FDTA Standards.

Background

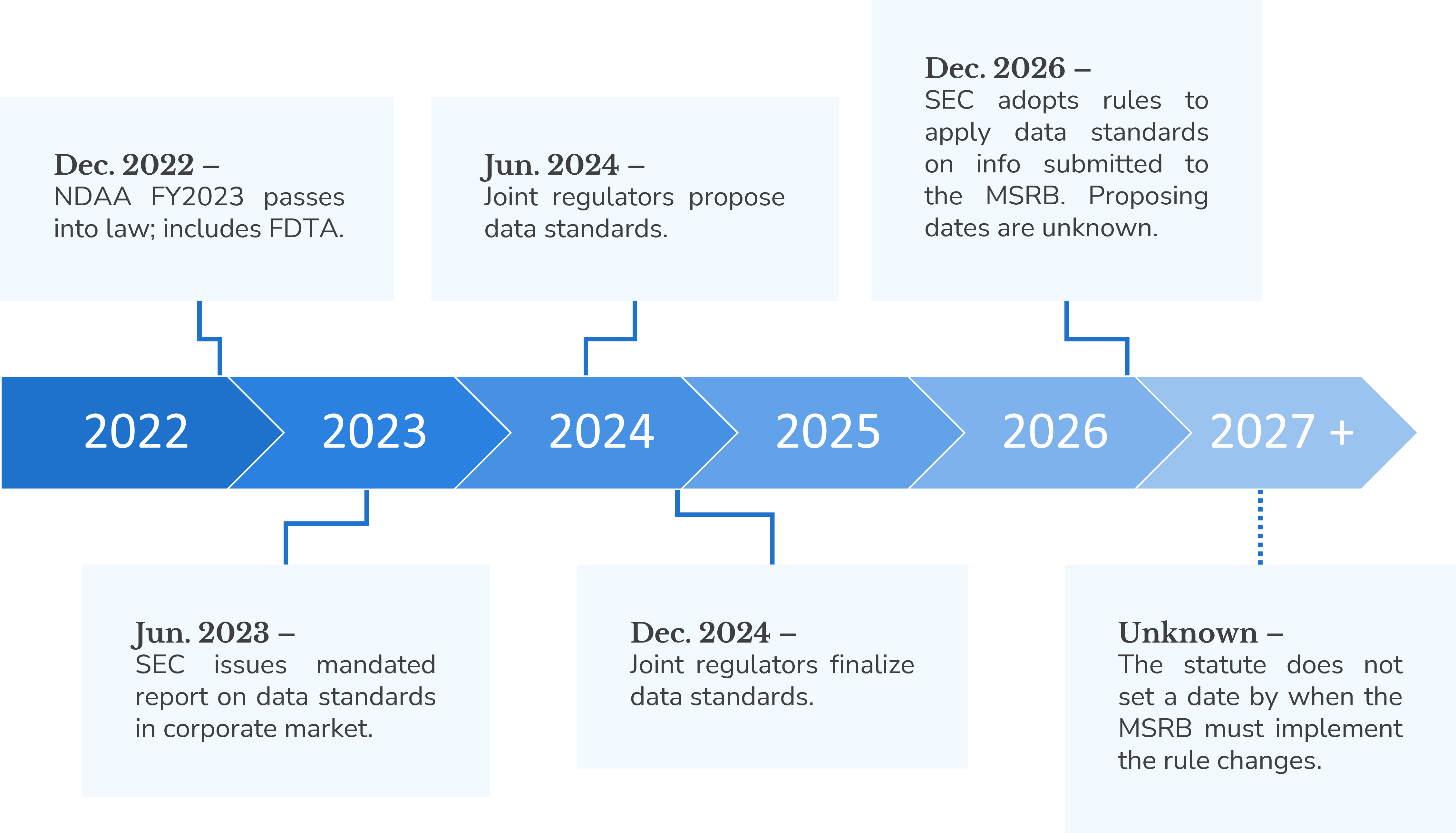

Throughout 2022, both chambers in Congress debated iterations of an FDTA.[i] The 117th Congress ultimately included and passed a version of the FDTA in the NDAA passed in December 2022. The final version of the FDTA included changes requested to earlier drafts by various municipal market groups, including empowering the SEC to handle rulemaking around how new data standards would apply to the MSRB. Earlier drafts originally authorized the MSRB to develop these rules via its own internal rulemaking process. A cohort of financial regulators has through 2024 to set a series of data standards, and individual entities have until the end of 2026 to apply standards to individual entities.[ii]

- Data Standards: Subtitle A instructs a series of federal financial regulators to jointly propose data standards for open comment by June 2024, and to finalize such standards by December 2024.[iii] The FDTA requires the joint standards to (A) “include common identifiers for collections of information reported to covered agencies or collected on behalf of the Council, which shall include a common nonproprietary legal entity identifier that is available under an open license for all entities required to report to covered agencies” and (B) “to the extent practicable—

- “(i) render data fully searchable and machine-readable;

- “‘(ii) enable high quality data through schemas, with accompanying metadata documented in machine-readable taxonomy or ontology models, which clearly define the semantic meaning of the data, as defined by the underlying regulatory information collection requirements;

- ‘‘(iii) ensure that a data element or data asset that exists to satisfy an underlying regulatory information collection requirement be consistently identified as such in associated machine-readable metadata;

- ‘‘(iv) be nonproprietary or made available under an open license;

- ‘‘(v) incorporate standards developed and maintained by voluntary consensus standards bodies; and

- ‘‘(vi) use, be consistent with, and implement applicable accounting and reporting principles.”

- Application to the MSRB: Section 5823 instructs the SEC to adopt data standards submitted to the MSRB that “shall incorporate and ensure compatibility with (to the extent feasible)” the joint standards mentioned above. This section requires the SEC to finalize such rules within two years of the joint data standards being finalized. It also requires the SEC to consult with market participants and scale regulatory requirements to minimize market disruptions.

- No New Disclosure Requirements: Section 5826 clarifies that nothing in the statute “shall be construed to require the [SEC], the [MSRB], or any national securities association to collect or make publicly available additional information under the provisions of law amended by this subtitle (or under any provision of law referenced in an amendment made by this subtitle), beyond information that was collected or made publicly available under any such provision, as of the day before the date of enactment of this Act.”

Timeline

Based on the deadlines laid out in the FDTA, we anticipate that regulators will roughly follow the timeline outlined below:

Why We Care

Many market participants remain concerned about the potential burdens the FDTA will place on the market, particularly for municipal issuers and borrowers. While many unknowns remain, a broad stroke approach in implementing the FDTA could overburden municipal issuers and borrowers who may already face limited resources and staff bandwidth. Any additional regulatory burden, particularly one without a clear benefit to the market, risks driving municipal issuers and borrowers from public markets to private placements. Bond lawyers should closely watch the implementation process and consider participating in regulator and NABL requests for input on this topic.

Our Stance

NABL joined nearly every municipal market group in raising concerns about the potential regulatory burden to municipal issuers and borrowers posed by the FDTA prior to its enactment. We now seek to ensure that implementation of the FDTA finds a balanced approach that maximizes efficiencies offered to the market and minimizes disruptions posed to issuers, borrowers, and other market participants. In the coming months and years, NABL expects to work with industry groups in the municipal market to provide comments in response to draft rules and other information to assist the SEC and MSRB in crafting rules applicable to the municipal market.

NABL FDTA Taskforce

In 2023, NABL assembled an internal taskforce to direct organization-wide work relating to the FDTA. The following members compose the taskforce:

- Deanna Gregory — Seattle, WA (Taskforce Chair)

- Carol McCoog — Portland, OR

- Hardy Andrews — New Orleans, LA

- Melissa López Rogers — Atlanta, GA and Orlando, FL

- Hillary Phelps — Chicago, IL

- Drew Slone — Dallas, TX

Latest from NABL on FDTA

Response to the Proposed FDTA Joint Standards

Comments in response to the joint data standards proposed by several financial regulators per the Financial Data Transparency Act (FDTA).

Agencies Release FDTA Proposed Joint Rule

While not final, the FDIC’s draft proposed rule offers insights into the work of covered agencies to implement the Financial Data Transparency Act (FDTA).

Six Takeaways from the Institute 2024

New format, new topics, new Institute. Here’s a recap from this year’s conference and what you may have missed.

Update from D.C. (October 2023)

An October 19, 2023 update on NABL’s recent advocacy efforts, a recap of recent legislative and regulatory activity that we are tracking, and some discussion on what may be in…

Hot Topics in Securities

This panel will include practitioners and securities regulators discussing the most pressing federal securities law issues facing the municipal bond market, with a focus on how to implement practical and…

NABL Goes to Washington

A recap of the Board of Director’s advocacy meetings in Washington, D.C. on May 17 – 19.

Agency Actions to Date

- [10/21/2024] Comments on Proposed Joint Rule Due: Stakeholders interested in providing comments in response to the Proposed Joint Rule must do so on or before October 21, 2024. NABL Summary on the Proposed Joint Rule >

- [8/24/2024] Proposed Joint Rule Published in Federal Register: The Proposed Joint Rules were published in the Federal Register, which officially starts the 60-day window in which to comment on them. NABL plans to submit comments on or before the due date of October 21, 2024. Read Federal Register Post >

- [8/2/2024] Several SEC Commissioners issue statements in response to the Proposed Joint Rule: Commissioner Hester Peirce highlighted the promise of market improvements that data standards may offer but emphasized that “this result is not guaranteed.” She shared her concerns that “mangling implementation could result in costs disproportionate to the benefits” and urged public comment on the Proposed Joint Rules. Commissioner Mark Uyeda focused on his concerns regarding the Commission’s potential move toward mandating filers to obtain a Legal Entity Identifier (LEI) prior to submitting information.

- [8/2/2024] SEC Releases Draft of Proposed Joint Rule: The Proposed Joint Rule issued by the SEC is near identical to the one released by the FDIC days earlier. Available Here >

- [7/30/2024] First Release of a Draft Standards Joint Rule: The Federal Deposit Insurance Company (FDIC) voted on and released a draft Notice of Proposed Rulemaking (NPRM) offering the first insight into the work of the covered agencies to implement the first phase of FDTA rulemaking. Read NABL Recap >

- [June 2023] SEC Report on Data in Corp Market: As required by Section 5825 of the Act, the SEC published a report on the use of machine-readable data for corporate disclosures. Read Report >

[i] House versions of the bill had been entitled Financial Transparency Act (“FTA”).

[ii] The FDTA applies data standard requirements to agencies beyond the SEC and MSRB. These agencies include the U.S. Department of Treasury; the Federal Deposit Insurance Corporation (“FDIC”); Office of the Office of the Comptroller of the Currency (“OCC”); Bureau of Consumer Financial Protection (“CFPB” or “BCFP”); the Federal Reserve Banks; the National Credit Union Administration (“NCUA”); and the Federal Housing Finance Agency (“FHFA”).

[iii] The group of federal financial regulators (“covered agencies” or “Council”) responsible for developing shared data standards are defined in the FDTA to include the Department of the Treasury; the Federal Reserve Board of Governors; the OCC; the CFPB; the SEC; the FDIC; the FHFA; the NCUA; and any other primary financial regulatory agency designated by the Secretary.