All in One Place

Resources

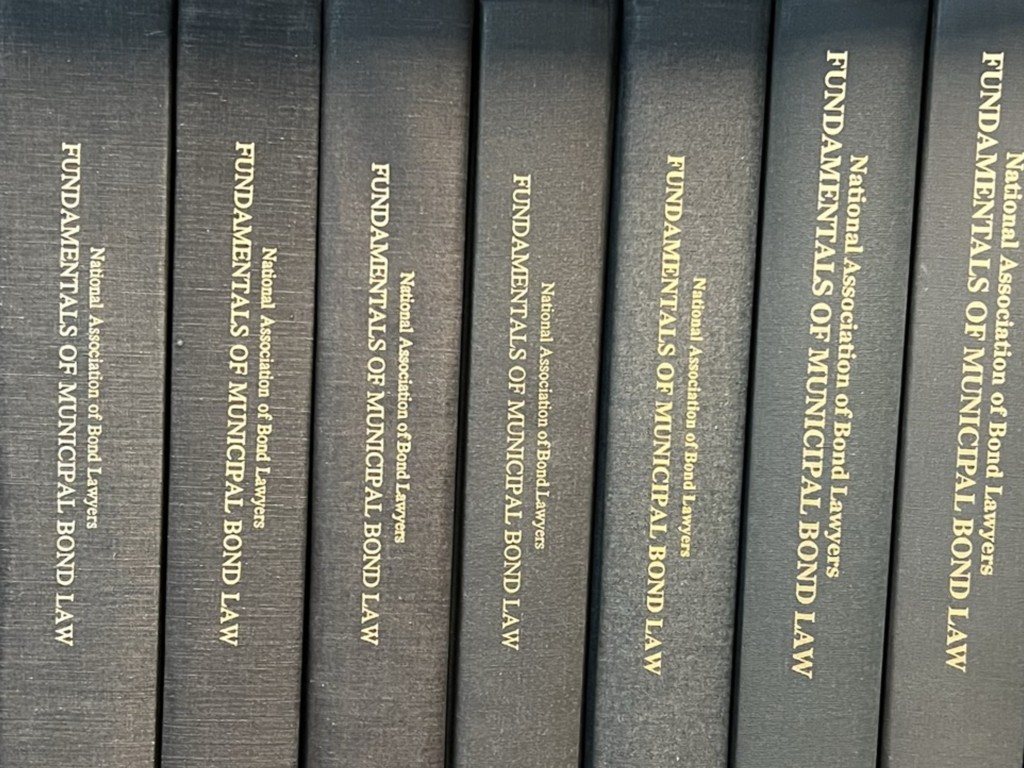

Browse through our library of resources ranging from reports and model documents, to webinars and comment letters.

Protecting Your Well-Being While Practicing in a Polarized Climate

This on-demand offering is free and not eligible for CLE credit.

PFN Letter: Second Session of 119th Congress

As the 119th Congress begins its second session, the Public Finance Network reiterates core policy priorities for the municipal market.

Muni Trades Response to SEC ABS Concept Release

NABL led coalition letter in response to an SEC proposal to harmonize the definition of “Asset-Backed Securities” under Regulation AB with that of the Exchange Act.

Muni Trades Request Extension on ABS Comment Deadline

A collection of associations representing various aspects of the municipal market request extension for recent SEC proposal on asset-backed securities.

The Workshop 2025: Session Bundle

If you did not attend The Workshop 2025, you can purchase access to individual sessions or the complete bundle: 10 sessions and 11+ CLE hours.

Artificial Intelligence – Intelligence Still Required! AI and Conflicts, Competence and Confidentiality (Workshop 2025)

Individual Webinar Purchase and watch the individual webinar at your convenience. Please allow up to 30 days for processing CLE credits. $99 for members | $299 for non-members Workshop 2025…

Private Activity Bond Tests: Real World Considerations (Workshop 2025)

Individual Webinar Purchase and watch the individual webinar at your convenience. Please allow up to 30 days for processing CLE credits. $99 for members | $299 for non-members Workshop 2025…

The Unraveling: Working Your Way Through Distress (Workshop 2025)

Individual Webinar Purchase and watch the individual webinar at your convenience. Please allow up to 30 days for processing CLE credits. $99 for members | $299 for non-members Workshop 2025…

The Unqualified Opinion of Bond Counsel (Workshop 2025)

Individual Webinar Purchase and watch the individual webinar at your convenience. Please allow up to 30 days for processing CLE credits. $99 for members | $299 for non-members Workshop 2025…

Exempt but Not Immune: Navigating the Maze of Tax Rules for Qualified 501(c)(3) Financings (Workshop 2025)

Individual Webinar Purchase and watch the individual webinar at your convenience. Please allow up to 30 days for processing CLE credits. $99 for members | $299 for non-members Workshop 2025…

Let Me Check With My Desk (Workshop 2025)

Individual Webinar Purchase and watch the individual webinar at your convenience. Please allow up to 30 days for processing CLE credits. $99 for members | $299 for non-members Workshop 2025…