Committee

Tax Law

Advises our organization on developments in federal tax law, including developments pertaining to the U.S. Department of Treasury and the Internal Revenue Service (IRS), and prepares comment letters, informative memoranda, and other written materials pertaining to tax law.

Latest from the Committee

Tax Law Committee January All-Hands

The NABL Tax Law Committee invites all members to attend its monthly all-hands call.

On the Application of PBU Rules to Modern Technologies

Comments to the IRS requesting written guidance on the application of the private business use rules related to modern technologies.

Requests for 2025-2026 IRS Priority Guidance

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2025-2026 Priority Guidance Plan.

Tax Due Diligence Matrix Gov Bonds

Starting point and road map designed to aid practitioners through the process of conducting tax due diligence for governmental bonds.

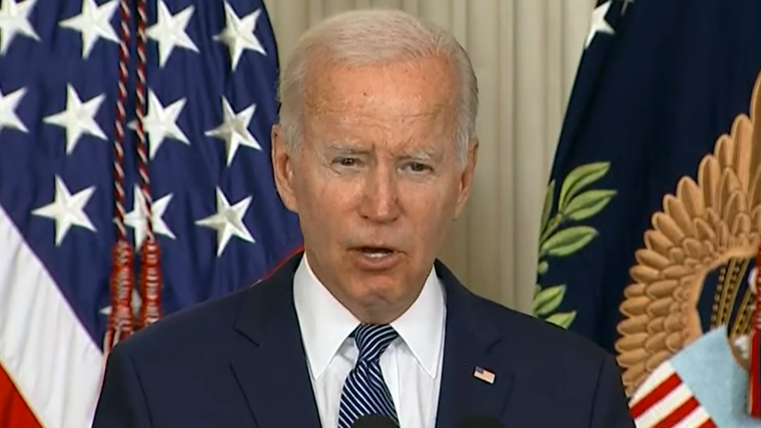

Protecting Tax-Exempt Municipal Bonds

Letter sent by the Public Finance Network (PFN), including NABL, to members of the 119th Congress in support of the tax exemption on municipal bonds.

Requests for 2024-2025 IRS Priority Guidance Plan

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2024-2025 Priority Guidance Plan.

Committee Leadership

Chair

Alison J. Benge

Pacifica Law Group LLP

Seattle, WA

Vice Chair

Eorl Carlson

Jones Hall, APLC

San Francisco, CA

Board Liaison

Jeff Qualkinbush

Barnes Thornburg LLP

Indianapolis, IN

Current Projects

Incidental Use Paper

A forthcoming paper focused on the “incidental use” exception to the private business use rules under development from the Tax Law Committee (TLC).

Featured Resources

Inflation Reduction Act

Large domestic policy package offering more than $400 billion in new federal investment and $300 billion in deficit reduction.

Infrastructure Investment and Jobs Act (IIJA)

Bipartisan infrastructure bill passed in late 2021 that enacted two new types of exempt facility bonds.

IRS Priority Guidance

View NABL request submissions for each year.