- News

House Republicans Unveil Debt Ceiling Plan

Speaker McCarthy released a bill to raise the debt ceiling in exchange for a number of Republican priorities. What we know and don’t know.

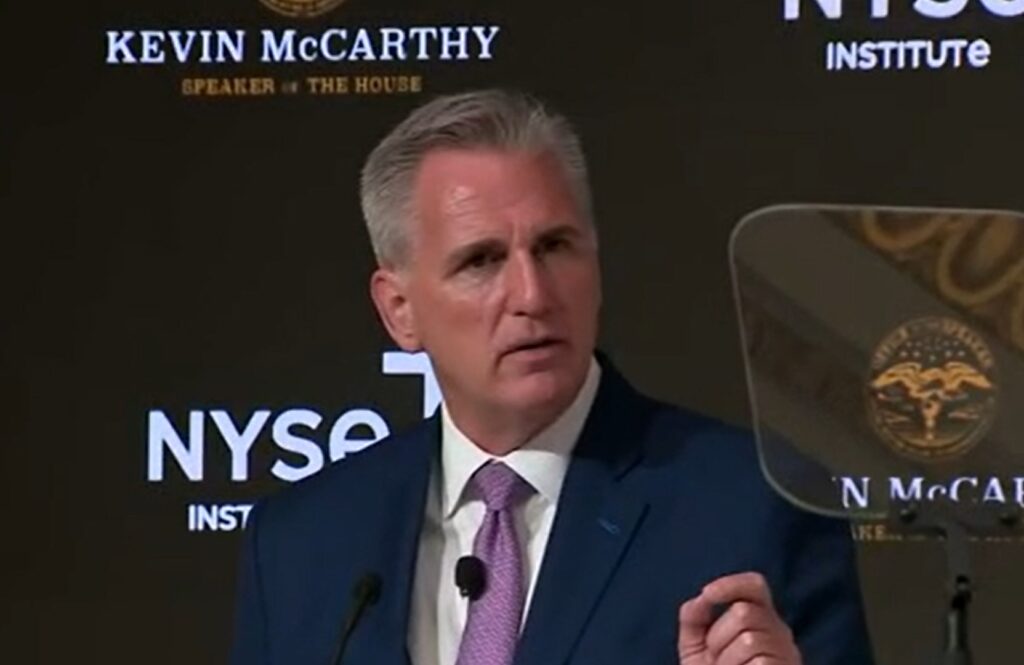

After months of anticipation, Speaker of the House Kevin McCarthy published legislative text to address the debt ceiling and reign in future spending on Wednesday. The bill specifically raises the U.S.’s self-imposed debt limit by $1.5 trillion— which is estimated to sustain the federal government’s borrowing through March 2024.

Title

A bill to provide for a responsible increase to the debt ceiling, and for other purposes.

Short Title

Limit, Save, Grow Act of 2023

Treasury Secretary Janet Yellen announced in a letter to Congress earlier this year that the federal government would reach its debt limit in late January. The letter also announced the beginning of extraordinary measures, which notably did not include the suspension of new sales of State and Local Government Series (SLGS) securities. Extraordinary measures allow the federal government to continue operations and debt service as normal until at least early June, at which point the U.S. risks default or massive spending cuts. The exact date, however, is subject to change depending on federal tax receipts and economic conditions in the coming months.

The 320-page bill includes a host of Republican policy priorities and provisions to control future spending. Division A locks in discretionary spending for next year at FY2022; a cut of more than $120 billion from the current fiscal year. It goes on to limit discretionary spending increases to one percent for the next 10 years.

Undoing IRA

The bill proposes a reversal of a number of clean energy tax incentives enacted under the Inflation Reduction Act (IRA), including reverting the maximum “haircut” to certain tax credits when used in conjunction with tax-exempt municipal bonds to 50 percent. IRA reduced the maximum haircut, outlined in Section 45(b)(3) of the Internal Revenue Code, to 15 percent. It also proposes clawing back certain unspent funding from pandemic-era aid programs, potentially including money sent to state and local governments; reforms to food assistance programs and Medicaid; and limits to the Administration’s ability to implement student loan forgiveness.

Speaker McCarthy now hopes to have his caucus rally behind and House vote on the proposal before restarting negotiations with the White House. President Biden maintains that addressing the debt ceiling is a nonnegotiable item and should be lifted without concessions. While the two main parties appear to remain at a stopgap, this week’s bill clearly marks the Republican starting line.

NABL will continue to keep members informed as information and updates become available.