- News

Final Regs for 8038-CP e-Filing

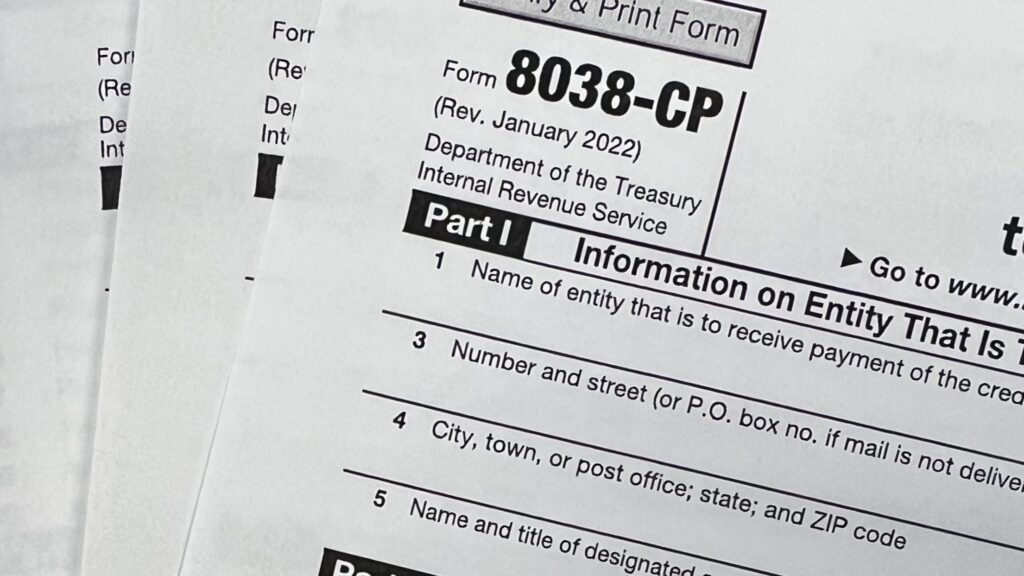

The Internal Revenue Service (IRS) finalized rules for electronic filing of Form 8038-CP last week.

The Federal Register published final regulations for the electronic filing of Form 8038-CP on Thursday, February 23, 2023. Issuers of certain tax-advantaged bonds, including Build America bonds, Recovery Zone Economic Development Bonds, and specified tax credit bonds, submit Form 8038-CP to request their direct payment equal to a percentage of the interest payments on these bonds. The Taxpayer First Act (TFA), passed by Congress in 2019, placed an emphasis on the IRS permitting electronic filing of various paper forms submitted by taxpayers and other stakeholders. Paper filing of Form 8038-CP became a sore point during recent government shutdowns when federal government employees, furloughed due to lapsed funding, were unable to process the paper submissions causing delays to the distribution of these promised payments to issuers. The final rules take effect immediately, and the requirement that issuers file electronically begins for forms submitted after December 31, 2023.