- News

Election Recap and Outlook

What’s left for the 117th Congress, and what’s ahead for the 118th Congress.

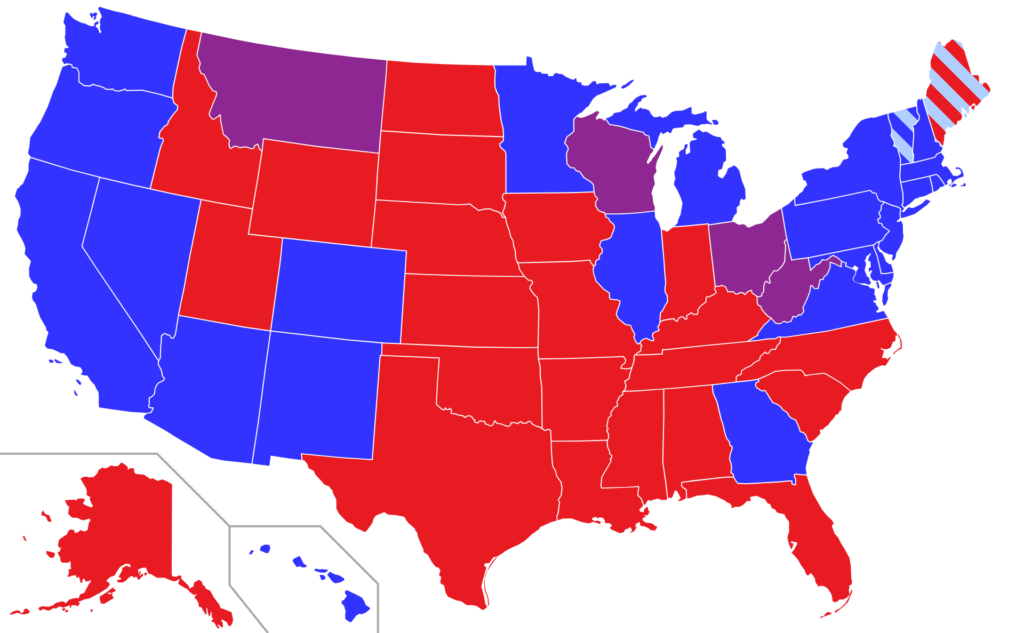

Final outcomes for a handful of elections remain undetermined, but at this point we know Democrats will hold the Senate and Republicans will control the House. Both majorities will rely on razor thin margins, although Democrats could expand their lead in the Senate by one seat pending the Georgia runoff election. Speaker Nancy Pelosi (D-CA) also announced she would step down from her leadership role after two decades at the helm of her party in Congress. Rep. Hakeem Jeffriers (D-NY) is widely expected to serve as the next leader for House Democrats when Pelosi rejoins the rank-and-file in January.

What Does it All Mean

A split Congress means the era of large, bold legislative agendas will likely come to an end for now. It also means a number of new faces will appear on Capitol Hill, many of whom may have limited knowledge on the importance of the municipal market to our communities. NABL remains committed to building our brand as an authoritative resource on issues relating to public finance law throughout the next Congress.

What Will (Should) Get Done in the 118th Congress

The new Congress’ agenda could start with any work the previous Congress left undone. In addition to the typical annual “must do’s” such as appropriations, potential tax extenders, and defense authorizations, the new Congress will also have a few big ticket items that will need attention:

- Debt Limit: The federal government will reach its self-imposed debt limit sometime mid-to-late next year. A split Congress will only further complicate the process of raising the limit in a timely manner.

- Farm Bill: The last farm bill, passed in 2018, expires next September. Congress will have to pass a massive package to extend lapsing programs and address a host of other policy issues related to farming, food safety, certain entitlement programs, and nutrition.

- FAA Reauth: Congress also has until next September to reauthorize the Federal Aviation Agency (FAA). While the package centers around funding and regulation of the airline industry, it also presents an opportunity to address other air infrastructure priorities.

Tracking NDAA and FDTA

The current Congress continues to work on passing the National Defense Authorization Act (NDAA) for next year. We continue to track the progress of the package and the potential inclusion of the Financial Data Transparency Act (FDTA). If enacted as proposed, Section 101 would require a group of financial regulators to develop data standards for other agencies, and Section 203 would require the Municipal Securities Rulemaking Board (MSRB) to create rules for any information systems established by the MSRB per 15B(b)(3) of the Exchange Act that have the characteristics outlines in the Section 101 data standards. NABL joined coalition comments expressing opposition to the inclusion of Section 203.

The ENABLERS Act

Some members of Congress are also working to include the Establishing New Authorities for Businesses Laundering and Enabling Risks to Security (ENABLERS) Act in the Senate’s version of the NDAA. The ENABLERS Act would expand the definition of financial institutions under the Banking Secrecy Act (BSA) in a way that could require certain attorneys to submit Suspicious Activity Reports (SARs) on your clients’ financial transactions. The American Bar Association (ABA) has expressed its concerns on the potential bill to Congress in an October letter.

As always, we will continue to keep members informed as developments occur.