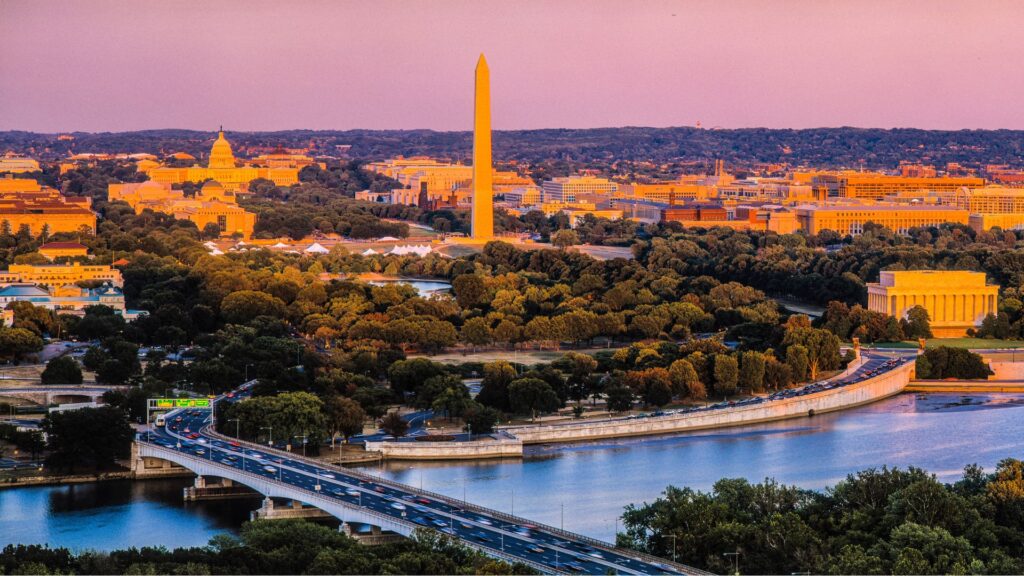

Inflation Reduction Act (IRA) of 2022 - Public Law Number (Pub. L. No. 117-169) (H.R. 5376)

119th Congress Begins

The new Congress has begun with a long agenda on tap. Here’s what we know coming out of the gate.

Requests for 2024-2025 IRS Priority Guidance Plan

Requested items for inclusion on the Internal Revenue Service’s (IRS) 2024-2025 Priority Guidance Plan.

Six Takeaways from the Institute 2024

New format, new topics, new Institute. Here’s a recap from this year’s conference and what you may have missed.

Groundhog Day in Washington

Congress’ long campaign of “hurry up and wait” stretches into February; a tax deal passes the House but faces uncertainty in the Senate; FY2024 spending update; and the SEC suspends…

Current Topics in Energy Finance

Review of current trends in energy finance, including a discussion by panelists of some of the priorities, objectives, and goals that are impacting the development and financing of energy and…

Tax Exempt Leasing

The Inflation Reduction Act (IRA) is the most significant legislation in U.S. history to ever address climate change, clean energy and sustainability. But you may be surprised to know that…

Refunding and Reissuance

Panelists focus on recent developments and discuss and analyze a variety of tax issues through a discussion of refunding and reissuance trends.

Demystifying Incentives in the Inflation Reduction Act (IRA)

The Inflation Reduction Act (IRA) is the most significant legislation in U.S. history to ever address climate change, clean energy and sustainability. But you may be surprised to know that…

Tax Hot Topics

This panel will discuss current federal tax issues, including any recently released notices, rulings, regulations and/or other guidance.

On Proposed Regulations for Section 6417 Elective Payments of Applicable Credits

Comment letter submitted to the Internal Revenue Service (IRS) in response to Proposed Regulations §§1.6417-1 through 1.6417-6 on Section 6417 Elective Payment of Applicable Credits (IRS REG – 101607-23).

Suppl. Comments on IRS Notices 2022-49 and 2022-50

Follow up comments to a November 4, 2022 letter sent by NABL suggesting various areas of need for guidance relating to certain tax provisions enacted under the Inflation Reduction Act…

Response to IRS Requests on IRA Implementation

Comments submitted in response to a solicitation from the Internal Revenue Service (Notices 2022-49 and 2022-50) for requests for guidance relating to certain tax law changes enacted by the Inflation…